529 Max Contribution 2024

529 Max Contribution 2024. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute. The contribution limits in new york are set at $520,000.

The contribution limits in new york are set at $520,000. You may contribute to a 529 plan at any time throughout the year, and you do not have to stop.

Effective January 1, 2024, Account Owners May Roll Money From An Edvest 529 Account To A Roth Ira For The Benefit Of The 529 Plan Account Beneficiary Without Incurring Federal.

Effective january 1, 2023, individuals qualify for a utah state tax credit for contribution.

Unlike Retirement Accounts, The Irs Does Not Impose Annual.

More than 6 in 10.

4 Things You May Not Know About 529 Plans.

Since each donor can contribute up to $18,000 per.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

529 Plan Contribution Limits For 2023 And 2024, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial planning made. 4 things you may not know about 529 plans.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

The Complete Guide To Virginia 529 Plans For 2024, How much can you contribute to a 529 plan in 2024? * $12,000 for tax years 2006.

Source: www.theeducationplan.com

Source: www.theeducationplan.com

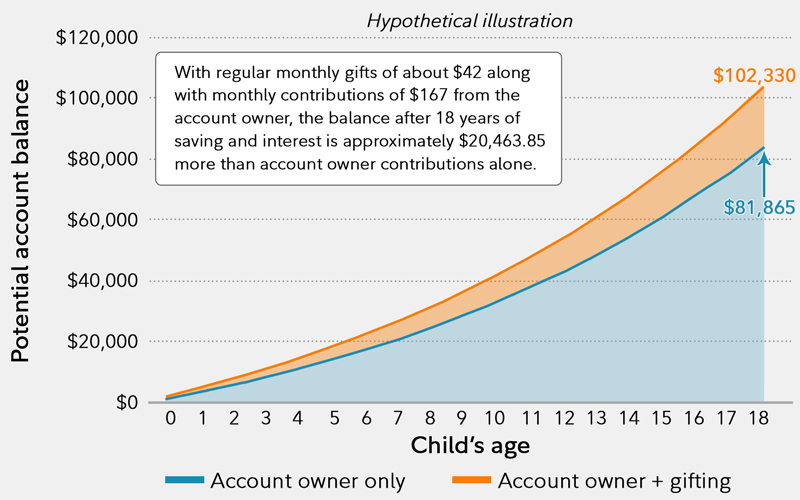

529 Maximum Contribution Limits in 2024 The Education Plan, Additionally, rollovers are subject to the maximum contribution limit for roth iras, up to $7,000 for investors 50 and younger for 2024. 529 contribution limits for 2023.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, The contribution limits in new york are set at $520,000. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: www.medben.com

Source: www.medben.com

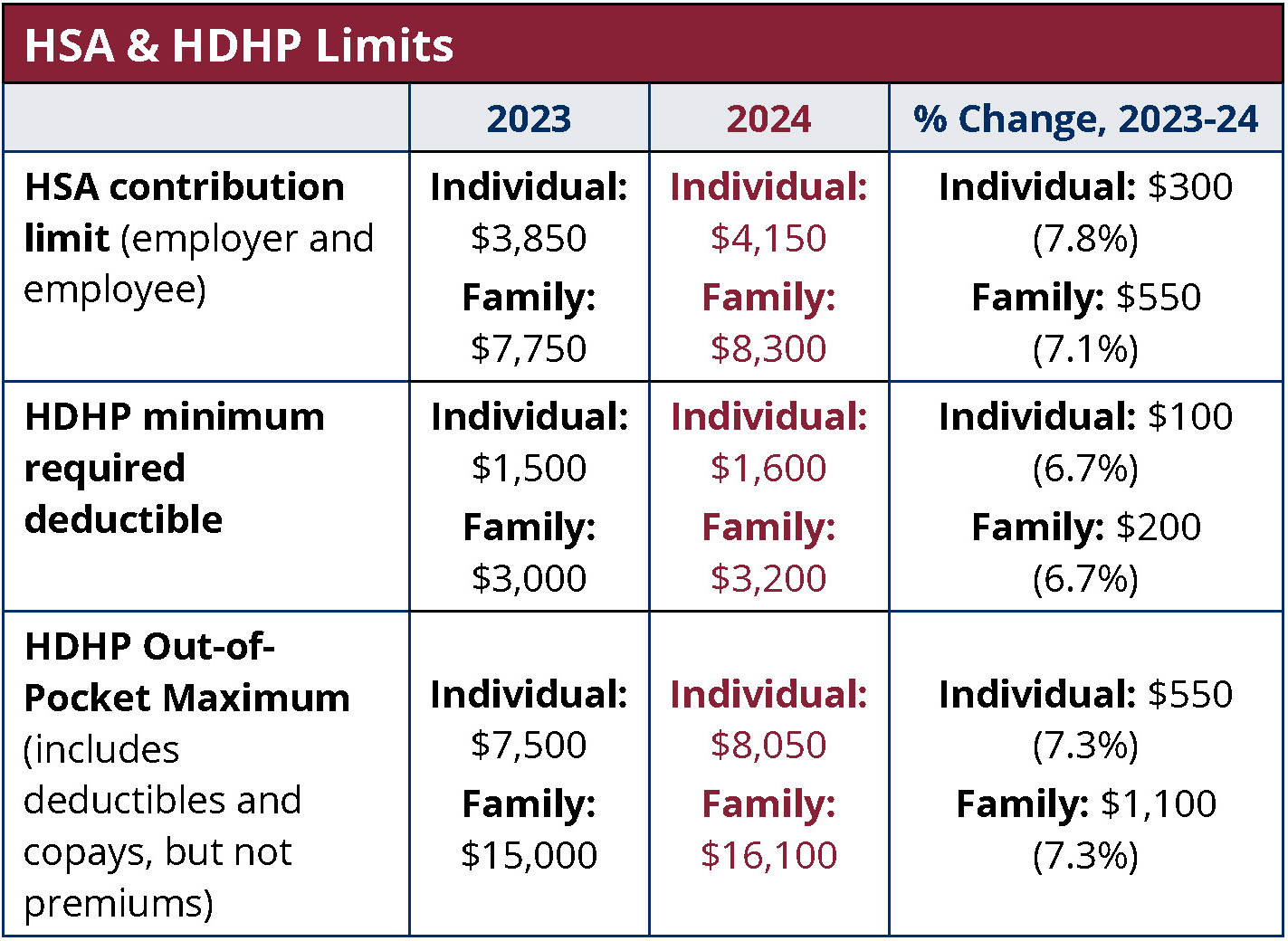

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, * $12,000 for tax years 2006. A recent change to tax.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, New york's 529 college savings program direct plan. 529 plan contribution limits rise to $17,000 in 2023.

Source: peaceofmindinvesting.com

Source: peaceofmindinvesting.com

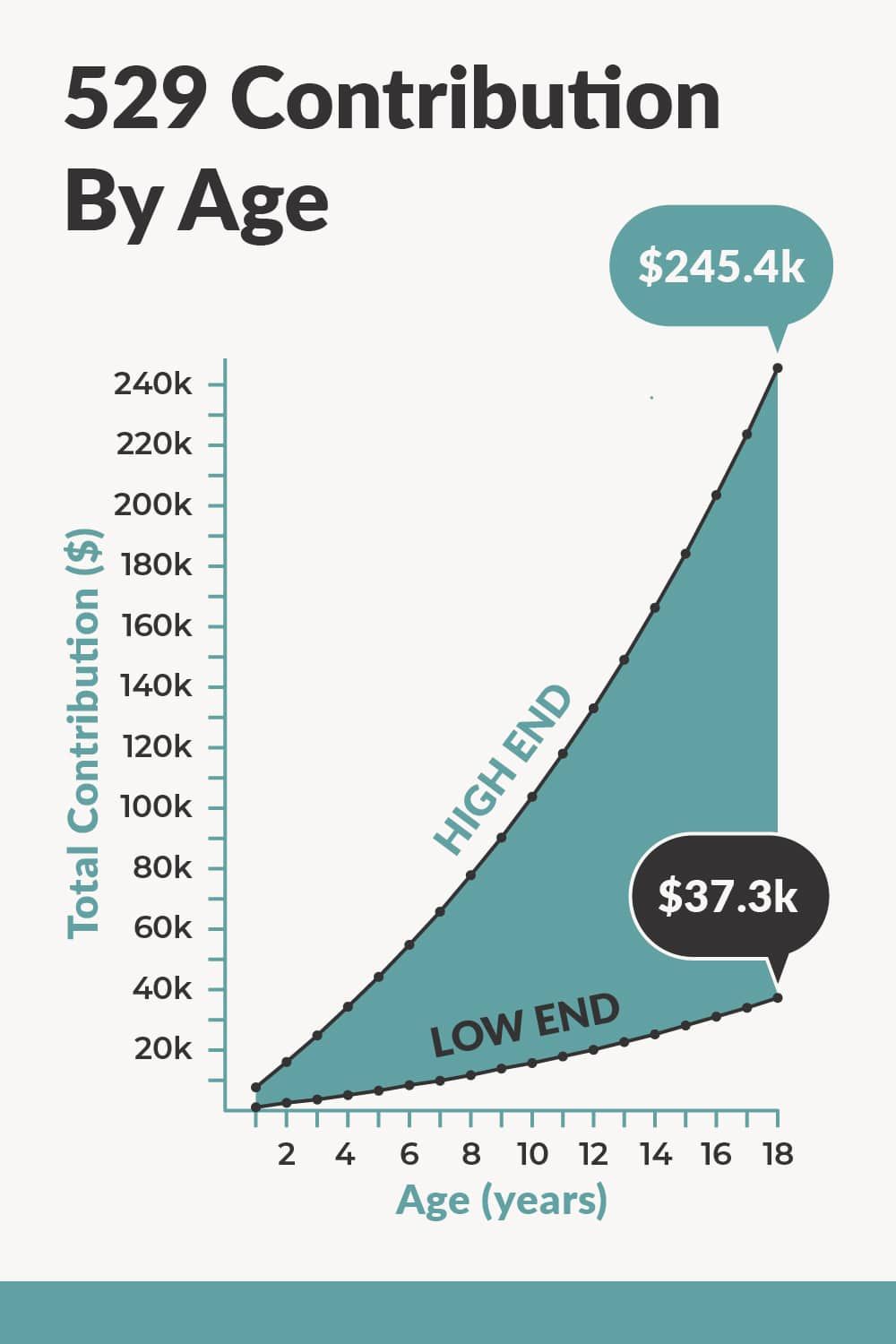

What Should you have in a 529 plan based on your age?, Each state's 529 plan has a maximum aggregate contribution limit, ranging from $235,000 in mississippi and georgia to $529,000 in california. How much can you save in a 529?

Source: www.fidelity.com

Source: www.fidelity.com

529 contribution The gift of education Fidelity, * $16,000 for tax year 2022. In 2023, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Max 529 Contribution Limits for 2024 What You Should Contribute, How much can you save in a 529? How much can you contribute to a 529 plan in 2024?

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, How much can you save in a 529? It currently offers $50 to all babies born or adopted on or after january 1, 2023, to a parent who is a.

529 Contribution Limits For 2023.

This is an aggregate contribution limit, meaning the maximum total can.

Utah Has Raised The Maximum My529 Contribution Amounts Eligible For A State Tax Credit.

“starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial planning made.

Since Each Donor Can Contribute Up To $18,000 Per.

Additionally, rollovers are subject to the maximum contribution limit for roth iras, up to $7,000 for investors 50 and younger for 2024.