How Much For Fsa 2024

How Much For Fsa 2024

The internal revenue service (irs) increased fsa contribution limits and rollover amounts for 2024. This means that if you have money left in your fsa at the end of the plan year in 2024, for any reason, you can keep.

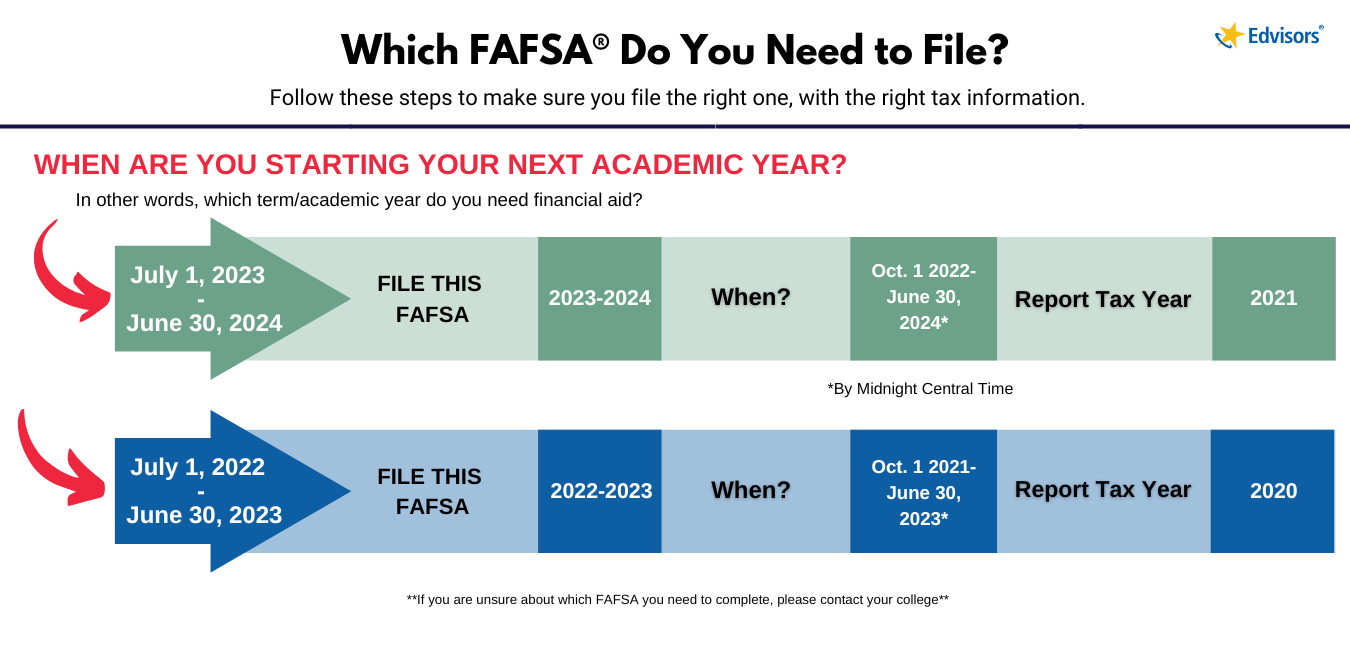

Fsa plan participants can carry over up to $610 from 2023 to 2024 (20% of the $3,050 fsa maximum contribution for 2023), if their employer’s plan allows it. For 2023, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage.

*The Maximum Allowed Irs Contribution To Your Fsa In 2024 Is Up To $3,200, However Your Employer May Enforce A Lesser Maximum.

The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2024 (up from $3,050 in 2023) employers may impose.

For Plans That Allow A.

Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2024, which is a $30 increase from 2023.

Images References :

Source: costanzawwilow.pages.dev

Source: costanzawwilow.pages.dev

Fsa 2024 Eligible Expenses Bella Carroll, Stay tuned for all the updates and latest developments regarding the budget 2024 announcement date, with. Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal.

Source: sybylqvaleda.pages.dev

Source: sybylqvaleda.pages.dev

Can Both Spouses Have An Fsa 2024 Tarah Francene, This handy fsa calculator will help you estimate your health spending for the year so you can make an informed decision and. Beginning in 2024, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this.

Source: www.cleveland.com

Source: www.cleveland.com

IRS increases FSA contribution limits in 2024; See how much, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Union budget 2024 date and time live updates:

Source: kelleywlenka.pages.dev

Source: kelleywlenka.pages.dev

Fafsa Deadline 2024 To 2024 Florida Gnni Phylis, For 2023, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage. In 2024, the fsa contribution limit is $3,200, or roughly $266 a month.

Source: m3ins.com

Source: m3ins.com

S3Ep1 2024 FSA Limits M3 Insurance, What are the 2024 fsa limits? Some employers offer a flexible spending account (fsa), enabling employees to contribute to a personal.

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Last Day To Claim Fsa 2024 Katya Melamie, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Union budget 2024 date and time live updates:

Source: ble-t.org

Source: ble-t.org

Open enrollment for 2024 Health FSA to run from now to October 31, 2023, For 2023, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage. But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: myemail.constantcontact.com

Source: myemail.constantcontact.com

FSA 2024 Updates and Key Dates, Fsas only have one limit for individual and family health. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

Source: www.dochub.com

Source: www.dochub.com

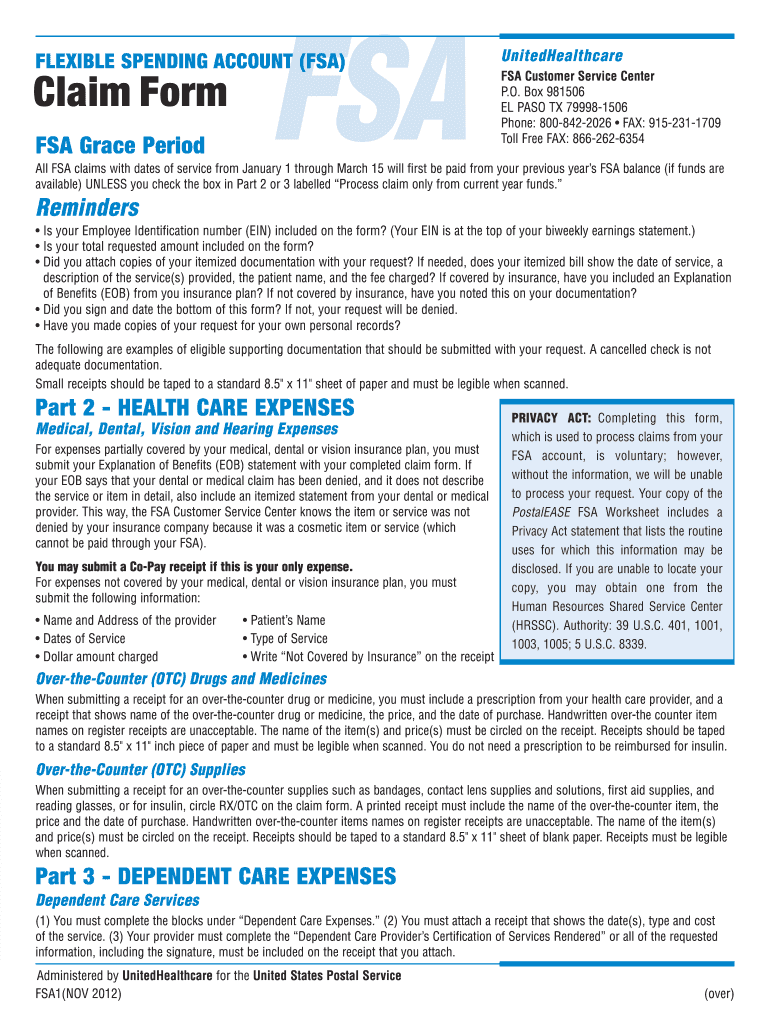

Fsa form Fill out & sign online DocHub, Here are the new 2024. Fsa plan participants can carry over up to $610 from 2023 to 2024 (20% of the $3,050 fsa maximum contribution for 2023), if their employer’s plan allows it.

![How FSAs Work and What They Cover [2021] FinanceBuzz](https://images.financebuzz.com/2304x1215/filters:quality(75)/images/2021/01/28/fsa-account.jpeg) Source: financebuzz.com

Source: financebuzz.com

How FSAs Work and What They Cover [2021] FinanceBuzz, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

A Large Number Of England Fans Spent Hours Getting Home From Their Euro 2024 Win Over Serbia Due To ‘Nightmare’ Transport Issues.supporters In The

But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Wrap With A Use By Date Up To And Including 18 June Should Not Eat It And Return It To The Store For A Refund.

The 2024 maximum health fsa.

Category: 2024